Explain Different Types of Tax Burdens

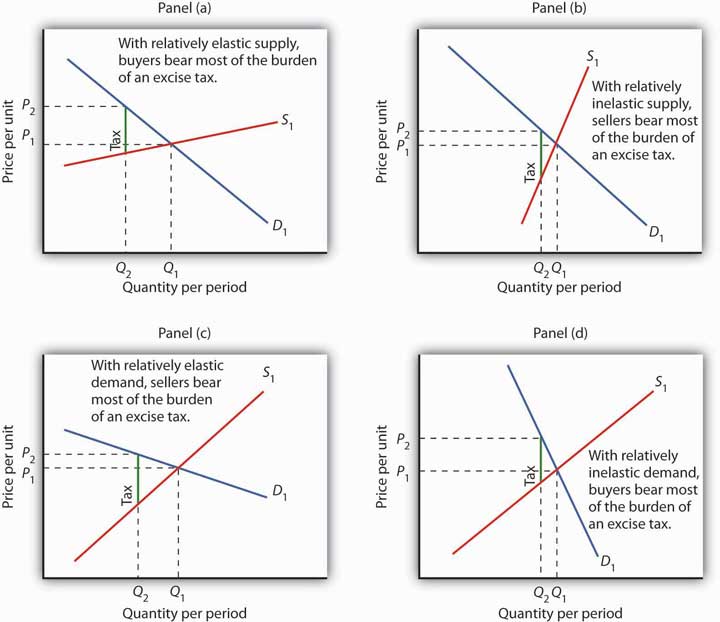

Tax incidence is the degree to which a given tax is paid or borne by a particular economic unit such as consumers producers employers employees etc. Consumer burden of tax.

Dividend Tax Rates In 2021 And 2022 The Motley Fool

TaxAct helps you maximize your deductions with easy to use tax filing software.

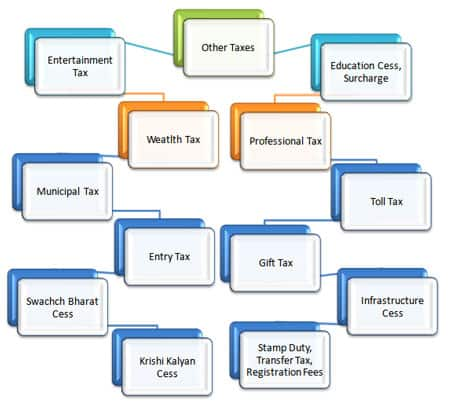

. Sales tax is levied by either the Central or the State Government Central Sales tax or 4 is generally levied on all inter-State sales. Therefore the consumer burden of the tax is 1 x 70 70. In a broader term there are two types of taxes namely direct taxes and indirect taxes.

You pay some of them directly like the cringed income tax corporate tax wealth tax etc while you pay some of the taxes indirectly like sales tax service tax value added tax etc. Types of Taxes Personal Income Taxes. Assessment in case of search.

Examples include direct and indirect taxes. However exports and services are exempt from sales tax. This is an extra 1.

The total consumer burden is the total amount of tax paid for by consumers. Sales tax applies to goods or services you buy and you pay them at the point of sale. Indirect taxes are those in which the taxpayer is not permanently the tax-bearer.

Taxes in which the rate of tax remains constant though the tax base changes are called proportional taxes. Tax incidence is of two types. Direct and Indirect Taxes 2.

Federal income tax and property taxes are direct taxes Below are four common types of consumption taxes. The consumer burden is the extra amount the consumers pay. Dalton also made a distinction between direct taxes and indirect taxes.

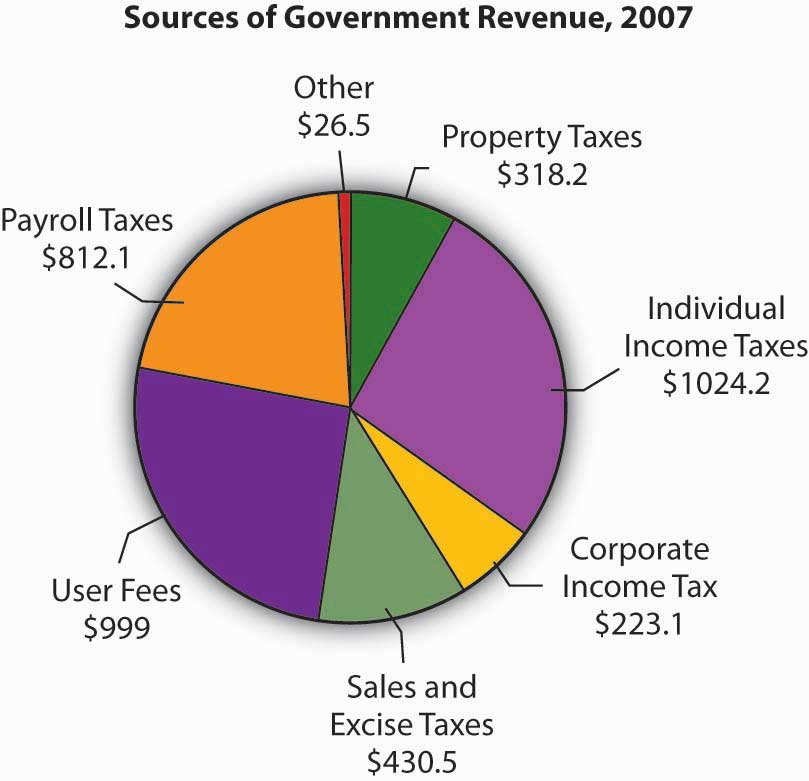

Property taxes are taxes imposed on assets. Income tax annual wealth tax capital gains tax are examples of direct taxes. Taxes are what the government uses to pay for public services.

State sales taxes that apply to sales made within a State have rates that range from 4 to 15. Specific and Ad-Valorum Duties 4. Direct taxes refer to taxes that are filed and paid by an individual directly to the government.

Sales taxes tariffs property taxes inheritance taxes and value-added taxes are different types of ad valorem tax. On the Basis of Method of Assessment. Tax burden on producer.

Example the incidence of a tax on cigarettes. Statutory incidence and. Excess burdens can be.

On the other hand indirect taxes are those whose burden can be shifted to others so that those who pay these taxes to the Government do not bear the whole burden but pass it on wholly or partly to others. However shifting of the tax burden is intended or desired. Local governments for example generally impose a.

Direct and Indirect Taxes. Taxes are the monies that you are required by law to pay to the government according to the amount of income money you receive the property you have etc. Sales Tax Service Tax VAT Custom duties and Octroi Excise duty.

Value-added taxes VATs Excise taxes. These types of taxes are common in state-level sales taxes but not common at the federal level. An ad valorem tax is typically imposed at the time of a transaction sales tax or value-added tax VAT but it may be imposed on an annual basis property tax or in connection with another significant event inheritance tax or tariffs.

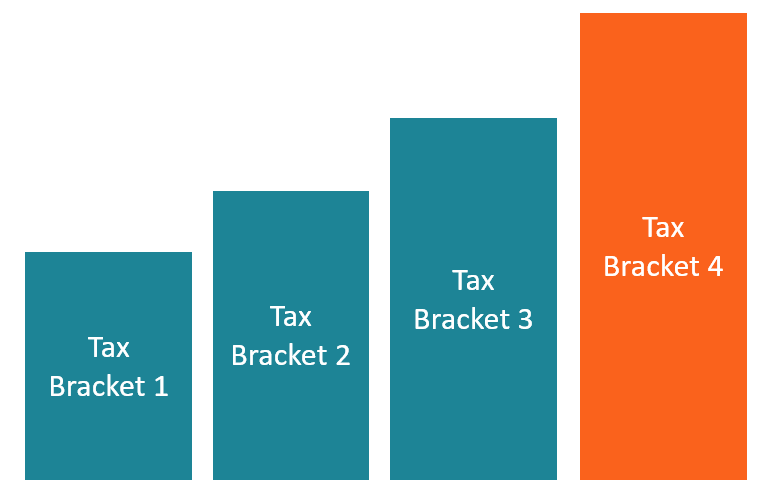

As explained above proportional taxes are regressive taxes. The implementation of both taxes differs. Direct taxes can be evaded in the absence of proper collection administration.

In case of a direct tax there is a direct contact between the tax payer and tax levying public authority. There are so many types of taxes. Economic theory posits that distortions change the amount and type of economic behavior from that which would occur in a free market without the tax.

A proportional tax is the same as a flat tax. In such a case the impact and incidence of tax fall on more than one person. When we say that the tax incidence of a given tax falls on A it means A ultimately pays or bears the burden of tax in greater proportion.

Therefore the burden of paying them can be put on another persons shoulders. Tax burden evenly split. This article throws light upon the four main types of taxes charged on taxpayers.

Indirect taxes on the other hand are taxes that can be transferred to another entity. A direct tax applies not to goods or transactions but to someones income profit or assets. The producer burden of the tax is the lost revenue to the firm.

Value Added Tax VAT. Service tax is a part of Central Excise in India. Taxes Levied by the Central Government and State Governments.

When demand is inelastic the tax burden is mainly on the consumer. When demand is elastic the tax burden is mainly on the producer. On the Basis of Incidence and Impact of Taxes.

Types of Assessment. All businesses and individuals pay taxes. Summary assessment us 1431 Scrutiny assessment us 1433 Best Judgment Assessment us 144.

In this case the tax burden is split evenly between the consumer and producer. Ad Import tax data online in no time with our easy to use simple tax software. On the Basis of Relationship between Tax Base and Tax Rates.

Proportional Progressive Regressive and Degressive Taxes 3. Tax burden on the consumer. Re-assessment or Income escaping assessment us 147.

The federal personal income tax is the largest single source of tax revenue in the United States. Taxpayers at all income levels would pay the same proportion in taxes. Of the tax burden to another person is not possible or not expected.

I Proportional taxes ii Progressive taxes iii Regressive taxes and iv Digressive taxes. One person pays the tax and another bears the burden of tax. There are four ways to classify different types of taxes in India.

TYPES OF TAXES. Producer burden of the tax. Self assessment us 140A.

In economics the excess burden of taxation also known as the deadweight cost or deadweight loss of taxation is one of the economic losses that society suffers as the result of taxes or subsidies. Under Income Tax Act 1961 there are four types of assessment as mentioned below. Indirect Tax In indirect tax the burden of tax is partially or wholly borne by a person who does not directly pay the tax ie.

Considering the relation between the tax rate and the tax base income there can be four types of taxation viz.

Tax Types Of Tax Direct Indirect Taxation In India

Reading Types Of Taxes Macroeconomics Deprecated

What Are Payroll Taxes And Who Pays Them Tax Foundation

Reading Types Of Taxes Macroeconomics Deprecated

Types Of Gst In India What Is Cgst Sgst Igst Utgst Explained

Why It Matters In Paying Taxes Doing Business World Bank Group

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Types Of Tax Direct Indirect Taxation In India

Why It Matters In Paying Taxes Doing Business World Bank Group

Progressive Tax Know How A Progressive Tax System Works

Progressive Tax Definition Taxedu Tax Foundation

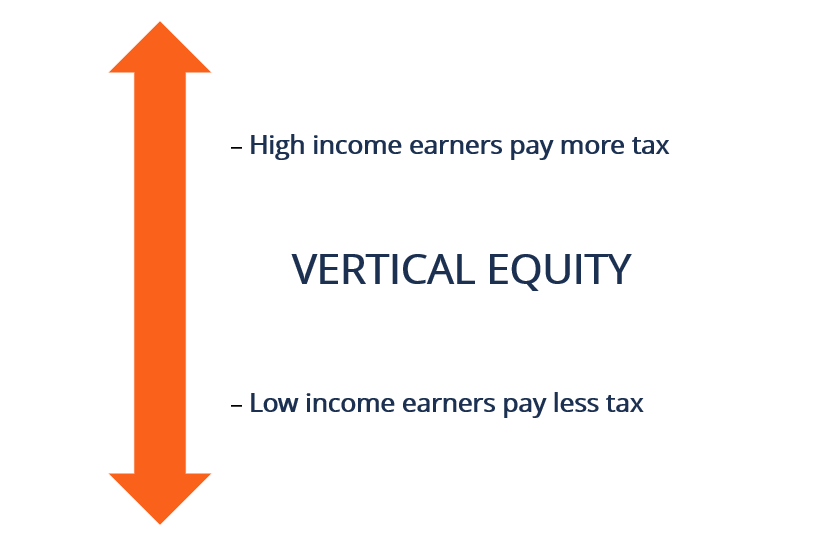

Vertical Equity Overview Vertical Taxation Regimes Example

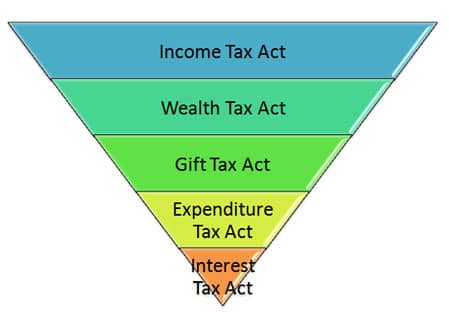

Indian Tax System Taxation Structure In India Current Policies Explainedaegon Life Blog Read All About Insurance Investing

What Are The Effective Tax Rates Of A Branch Office In Singapore Singapore Business Singapore Business Infographic

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Types Of Tax Direct Indirect Taxation In India

Comments

Post a Comment